Why Minimum Repayments On Credit Cards Is Not Enough?

June 18th, 2021

Minimum repayment on credit cards is set as the percentage of your balance to be payable on a monthly basis. Monthly interest and other charges can be added to this amount which is paid to the card provider so as to save the customer from a bad credit report. If you pay at least this much then you will not earn negative points on your credit report. However, this is not the best solution of repaying the debt. Why? Check below!

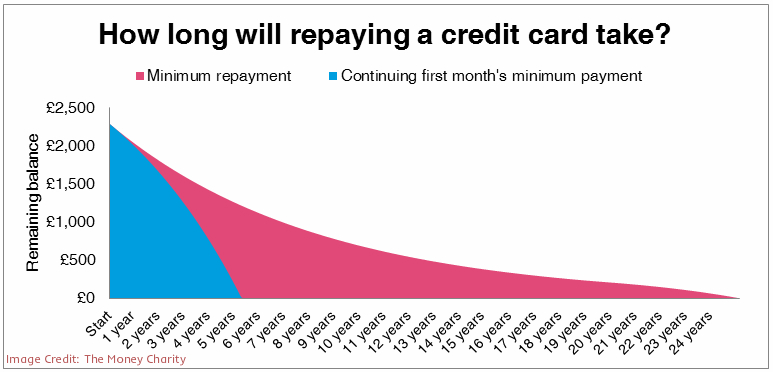

All credit card providers will want you to pay at least the minimum repayment on a regular basis. The poor customer may think the provider is facilitating them in managing the debt by just taking the minimum amount but that would be incorrect. By just paying this amount the provider puts you in a situation where your debt continues for a long time. You must realize that this small monthly amount is some small percent of your debt amount and if you pay it this month then you will be charged on the balance. In this way, you end up continuing with the debt and higher interest rates. The interest can actually strip you off so, don’t relax if you are just paying the minimum repayment amount. Check the actual consequences!

Why only minimum repayment is a dangerous thing?

You pay the repayment amount and add interest: By paying just the repayment you keep spreading the debt amount over longer periods of time. This way, you end up with higher interest on the balance amount which can be 15% to 40% annually. Now, see whether that is affordable or not?

Debt increases and so does the repayment: As the debt increases, you are liable to pay more repayment amount at the end of the years. So, it actually increases the repayment amount for which you might not be prepared. So, think before increasing your debt.

Interest for years: As you pay the least every month, your balance amount reduces quite slowly. On top of this high interest gets added to the total amount inflating the entire repayable amount. So, you will fall into the trap of paying high interest over the balance.

How to beat the minimum repayment trap?

Fixed repayment: To come out of the minimum repayment, maximum interest trap just make sure that you pay a fixed amount on a monthly basis. Whatever is affordable to you, just make sure that the monthly payment covers the minimum repayment plus monthly interest so that you stop accumulating money over the years. This fixed amount should be paid without any delay.

Cut down the interest: The best way to cut down high interest is to buy a balance transfer card and get your balance from the standard credit card transferred to this new card. Balance transfer cards come with an interest free period which can be up to 27 months or more. So, once you have balance on this card you can start paying the debt at 0% interest. Also, you should finish the debt within the interest free period.

Set direct debt: You must set a direct debit from your bank account to your credit provider. This way, you will not miss any monthly payment and still get your debt paid at a slow yet certain pace. Make sure this amount covers the minimum payment and a portion of the interest too. This will reduce the total amount over a span of few months and surely pull you out of the debt.

The major benefits of minimum repayment are that it won’t get you a bad credit rating as you will not miss any payment. In addition, if you have any bigger debt then you can manage both by paying a small amount on the card and another portion for the second debt.

Better still you should not keep yourself limited to paying minimum repayment amount. Work towards decreasing your total balance so that the cycle of cumulative interest can end. For more on credit cards, check www.freepricecompare.com. Feel free to contact us on 02034757476.